Selecting the right inertial navigation system (INS) is one of the most difficult challenges for procurement officers and system integrators. With dozens of MEMS INS suppliers worldwide, it’s not easy to separate consumer-grade sensors from industrial and tactical solutions. Choosing the wrong supplier can mean unstable navigation, wasted budgets, and failed missions.

The good news? In 2025, several suppliers stand out for their ability to deliver high-performance, reliable MEMS INS modules across defense, aerospace, UAV, marine, and industrial automation applications.

The top 10 MEMS INS suppliers in 2025 include Honeywell, Analog Devices, GuideNav, Safran, TDK InvenSense, STMicroelectronics, Sensonor, Silicon Sensing Systems, Aceinna, and SBG Systems.

These companies lead the global market with proven solutions for defense, UAVs, autonomous vehicles, and industrial navigation.

MEMS INS has become a cornerstone technology for navigation in GPS-denied environments, offering small size, low power consumption, and cost efficiency compared to legacy solutions. The following ten companies represent the most influential MEMS INS suppliers in 2025, each with unique strengths tailored to specific mission requirements.

Table of contents

1. Honeywell International Inc.

Headquarters: USA

Core Strength: Aerospace and defense-grade MEMS INS, MIL-STD compliance, decades of heritage.

Pro:

- Proven reliability in mission-critical platforms.

- Wide performance range from industrial to tactical.

- Strong global technical support.

Cons:

- Higher cost.

- Longer lead times.

- Oversized for cost-sensitive projects.

Honeywell is a trusted name in inertial navigation, with MEMS INS solutions deployed in aircraft, defense vehicles, and industrial systems. Known for unmatched reliability, Honeywell is ideal for programs where certification and long-term support matter most.

2. Analog Devices (ADI)

Headquarters: USA

Core Strength: Precision MEMS IMUs and sensor chains, supporting industrial and automotive INS.

Pros:

- Low noise density and stable performance.

- Comprehensive documentation and tools.

- Reliable supply chain.

Cons:

- Larger footprint and power use at higher performance levels.

- Limited defense specialization.

- Customization may require extra effort.

Analog Devices powers many industrial and automotive INS modules, offering high-precision IMUs with consistent performance. ADI is a preferred choice for large-scale projects requiring reliable sensors with long-term availability.

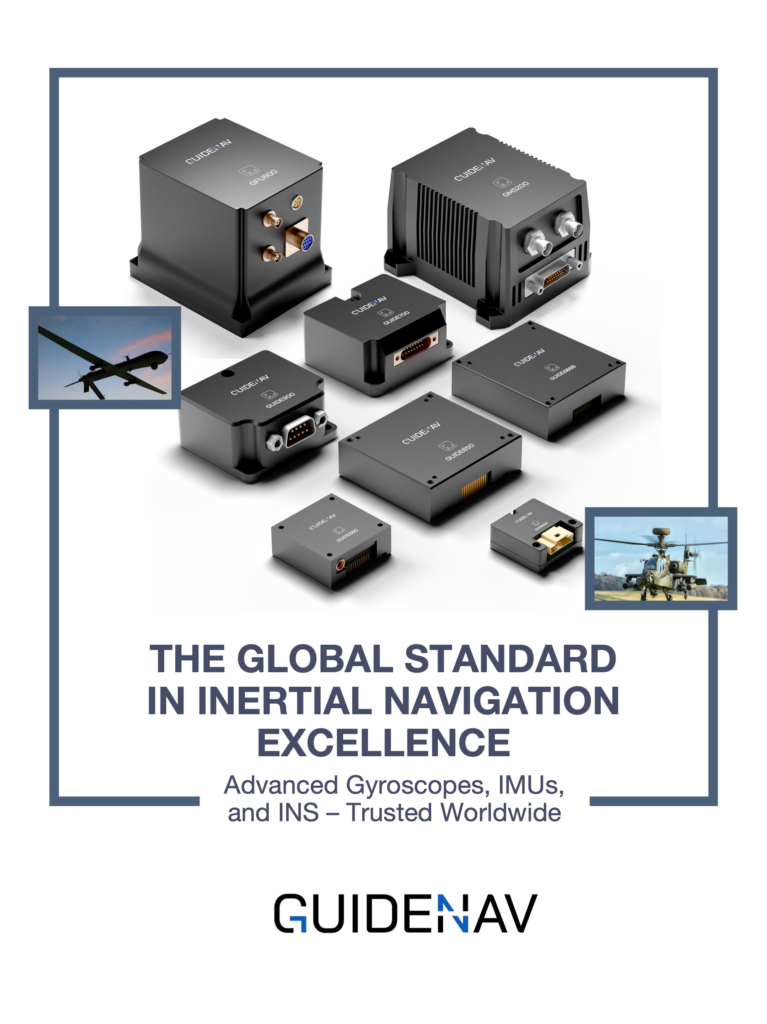

3. GuideNav

Headquarters: China

Core Strength: Export-compliant, tactical-grade MEMS INS with rugged design and strong customization.

Pros:

- High performance in vibration and shock environments.

- Non-ITAR, export-friendly.

- Tailored solutions for UAVs, defense vehicles, and industrial platforms.

Cons:

- Brand recognition still growing globally.

- Less focused on consumer electronics.

- May exceed requirements for entry-level projects.

GuideNav is an emerging leader in MEMS INS technology, offering tactical-grade modules designed for demanding UAV, defense, and industrial missions. Its combination of rugged reliability and export compliance makes it a compelling choice for international procurement.

4. Safran / Colibrys

Headquarters: France / Switzerland

Core Strength: Rugged, certified MEMS INS for aerospace, defense, and marine.

Pro:

- Very low drift and long-term stability.

- MIL-STD performance.

- Trusted in aerospace and defense programs.

Cons:

- Premium pricing.

- Longer development cycles.

- Less suitable for cost-sensitive UAV or robotics projects.

Safran, via Colibrys, provides MEMS INS modules designed for extreme reliability in aerospace and defense. Their solutions are favored in projects demanding certification and rugged operation.

5. TDK InvenSense

Headquarters:

Japan / USA

Core Strength:

Compact, low-power MEMS IMUs for embedded INS.

Pro:

- Highly miniaturized and efficient.

- Cost-effective for mass deployment.

- Broad market adoption.

Cons:

- Lower accuracy than tactical-grade solutions.

- Limited ruggedization.

- Customization options restricted.

TDK InvenSense specializes in miniaturized IMUs widely used in drones, robotics, and IoT devices. For procurement targeting compact, power-efficient systems, TDK offers strong value.

6. STMicroelectronics

Headquarters:

Switzerland / France

Core Strength:

Automotive-certified MEMS INS with strong safety and industrial focus.

Pro:

- Compliance with automotive standards.

- Integrated machine-learning features.

- Global support and supply.

Cons:

- Higher drift than defense-grade INS.

- Not optimized for extreme tactical use.

- Customization limited.

ST provides MEMS IMUs for automotive, robotics, and industrial INS solutions. Its modules are widely adopted for safety-critical systems, making them attractive to procurement in automotive and automation.

7. Sensonor AS

Headquarters: Norway

Core Strength: Ultra-low drift MEMS INS for aerospace, defense, and subsea.

Pros:

- Extremely stable under long missions.

- Proven in high-vibration environments.

- Tactical-grade performance.

Cons:

- High unit cost.

- Narrower product line.

- Requires skilled integration.

Sensonor is known for MEMS INS products with tactical-grade performance. Its solutions are trusted in aerospace and subsea applications where reliability under harsh conditions is critical.

8. Silicon Sensing Systems

Headquarters: UK / Japan

Core Strength: MEMS gyroscope expertise with robust INS modules for industrial and marine use.

Pros:

- Long-term reliability.

- Strong diagnostics and calibration.

- Proven in maritime and rail.

Cons:

- Larger form factors.

- Slower update rates than tactical-grade INS.

- Limited customization.

Silicon Sensing offers MEMS-based INS modules well-suited for continuous operations in marine, industrial, and land navigation. Known for stability, they are a safe procurement choice for safety-critical domains.

9. Aceinna

Headquarters: USA

Core Strength: Cost-effective MEMS INS with flexible interfaces for UAVs and robotics.

Pros:

- Affordable pricing.

- Compact designs for mobile platforms.

- Developer-friendly open tools.

Cons:

- Not tactical-grade.

- Limited ruggedness.

- Export compliance varies.

Aceinna delivers accessible MEMS INS modules used in UAVs, robots, and industrial machines. With competitive pricing and open-source tools, it appeals to cost-conscious integrators.

10. SBG Systems

Headquarters: France

Core Strength: Lightweight, high-precision MEMS INS with advanced GNSS/INS fusion.

Pros:

- Compact, portable designs.

- Excellent GNSS integration.

- Popular in UAVs and mapping.

Cons:

- Premium cost.

- Not specialized in tactical ruggedization.

- Integration support varies regionally.

SBG Systems is a specialist in MEMS INS for UAVs, marine, and surveying platforms. Their advanced fusion algorithms make them a top choice for mapping and lightweight applications.